INVESTMENT POSITIONS – APRIL 17, 2025

Joe Cantu from Cantu Tactical Wealth Management for our clients, I will show you a chart of some of our stocks and fixed income investments. I will also show you the growth rate at the end. I’m going to show you some interesting trading aspects. [Video link, with more detailed charts, is at the end of this post]

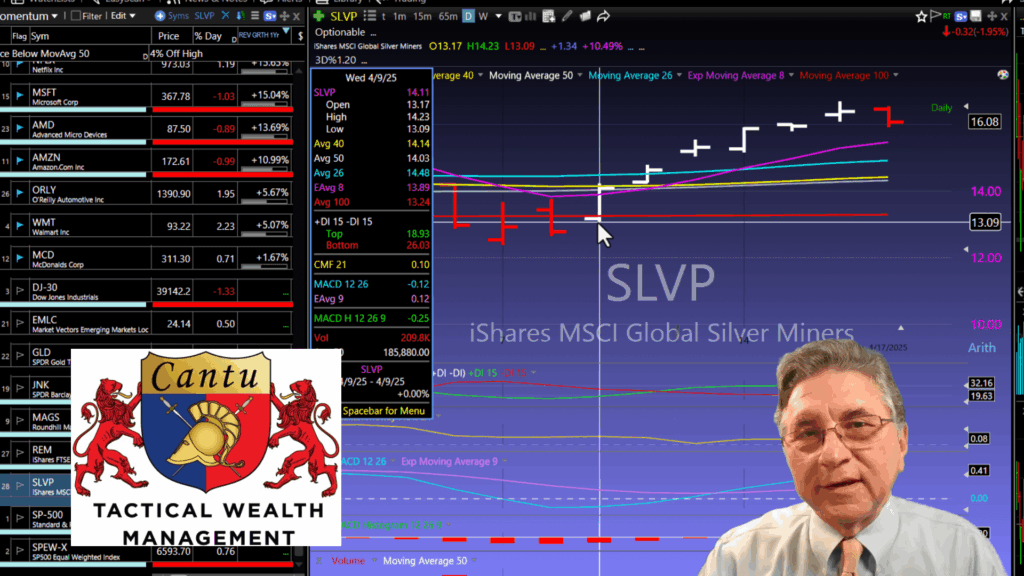

Let’s get started. I’m going to start off with the silver miners. Now let me go over the chart. This chart represents the open, high, low and closing price for the day. This is on April the 9th. You can see silver miners moving up. Real estate mortgage investment trust pays a lot of income. Just added this to the portfolio. A nice chart moving up. Magnificent 7 had three down days and had a big up day on the 9th.

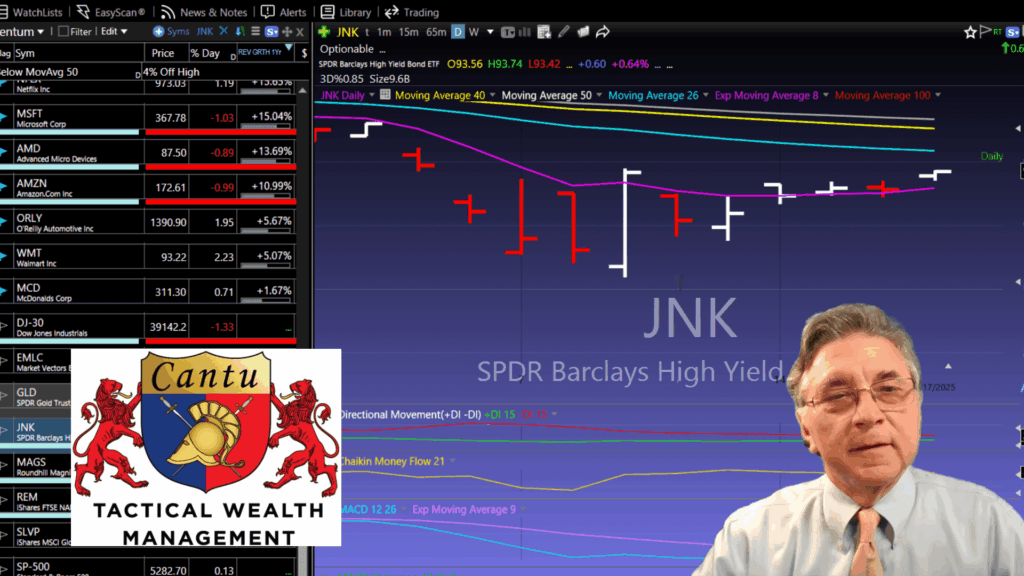

High yield corporate bonds. We added this to the portfolio “Junk bonds” is the slang term in the business. It is one of the first asset classes to move up. Many of you have been our clients for several years, know that it’s one of the purchases we make here at the firm moving out of a low market or recession. As you can see, moving up nicely pays over 6% dividend income as well.

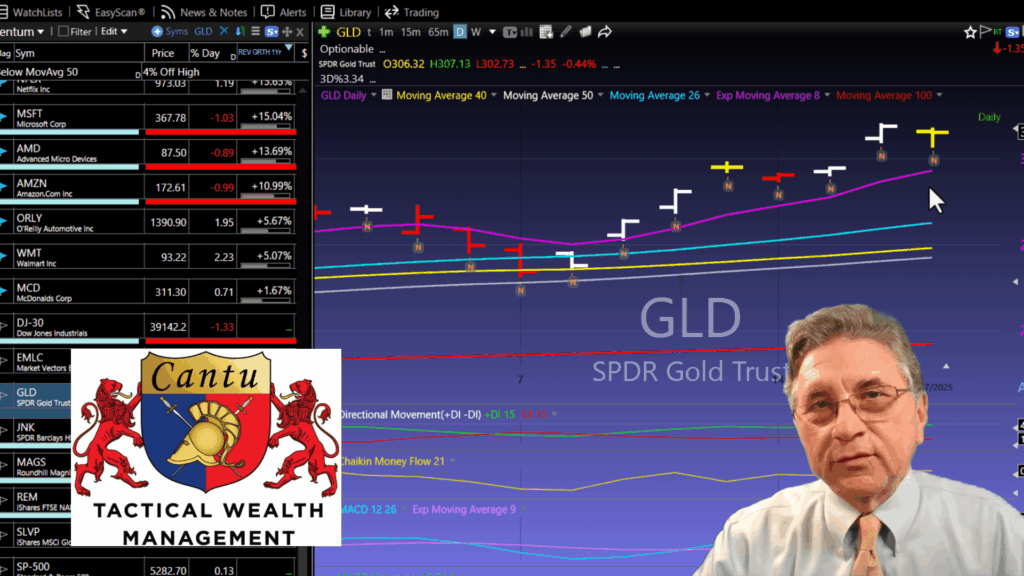

Here is gold. Now I know gold has had a lot of headlines. It’s moving up. I will talk about this indicator at the end. It’s moving up. But it seems to maybe have leveled off. This is an interesting chart.

EMLC, an ETF, this is a bond investment. What’s interesting about this, it goes up with a weak U.S. dollar. So, as the weak dollar gets weaker, this price of this investment, actually, goes up. McDonald’s, a core holding doing well moving up. Walmart has, actually, started moving up April the 7th, doing well, core holding. O’Reilly Auto parts exempt from tariffs. Many of its products, you can see it had a nice day on the 9th moving up. Amazon, struggling a little bit, had four down days but had a strong day on the 9th.

Advanced Micro Devices strong day on the ninth couple of down days. Microsoft Strong day on the 9th accept 4 down-days. Netflix just came out with earnings, steadily moving up. Uber, actually, started moving up on the 7th. Yes on the 7th. Moving up steadily it just released earnings a couple of weeks ago. Royal Caribbean kind of going sideways had a strong day on the 9th.

Meta in the courts defending its position on some acquisitions. It’s had a few down days, had a strong day on the 9th as well. Hess energy going sideways but has a strong growth rate. If you can see the growth rate on Hess is 22% for the year. Now, Palantir, the income strategy has owned it for a while. We just, had bought it in the momentum strategy, but you can see it’s moving up. “Realty Income” we just purchased it less than a week ago because interest rates are moving down as you can see, it’s had since the 9th. It’s had straight up days. It’s had no down days steadily moving up.

Diamondback energy has a growth rate of 31% very strong. You can see it’s moving up steady now, Broadcom, Broadcom started moving up on the 7th, had a big day on the 9th. What’s interesting about Broadcom, it has a 40%, a 40%. Revenue growth rate, that means it’s made it in one year, it’s increased its revenue by 40%. Now, Robin Hood moving up since the 7th has a growth rate of 58%.

Micron moving sideways a little bit growth rate of 71%. NVIDIA. Which you know is makes a self-learning chip for AI started moving up on the 7th strong day on the ninth has moved down in the last couple of days but it has a growth rate of 114%. Amazing it’s has doubled its revenue in the last 12 months and has done so for the last few years. “SMCI” In the momentum strategy has a growth rate of 125%. It’s amazing the growth rate. Now, it’s struggling since the 9th, but it has one of the highest growth rates in the nation.

If we look at the income strategy, they also own eBay. eBay is steadily moving up. Palantir steadily moving up. JP Morgan Chase steadily moving up, started moving up since the 7th. Had a few down days. T-Mobile. Steadily moving up. And convertible bonds.

Let me show you some interesting trading indicators. This is gold. If you look at Gold, Gold has been moving up, but you see this indicator where it opened, traded high, low and it closed almost at the same price. That’s an indication that perhaps traders have peaked out on that position. Typically, when we see this type of indicator right here. It’s a Japanese word called “doji”. It means the same. You have an indication that over the next two to four days. About 2/3 of the time, the stock could be trading down. It is a gold bullion trust, so we’ll just have to wait and see. But what’s interesting is if you look at silver, it had a down day on Thursday and if you go to the income strategy and look at the “gold miners”. It has the same indication right there. So, again, it’s possible that the precious metals could have peaked out.

To watch the video: